F&I Products

Vehicle Protection Plans

New vehicles may be covered by the manufacturer’s warranty, but once that has run out, you are responsible for any breakdowns that might occur. By adding a Used Vehicle Protection Plan to your vehicle you will help offset the cost of any repairs you may need.

GAP Insurance

Gap insurance pays for the difference between the value of a car at the time it’s totaled or stolen and the balance of its loan or lease. Though it seems to refer to that difference, “gap” actually stands for “guaranteed asset protection.”

Roadside Assistance

Just like repairs can be unexpected so can be the time you need them. Road Side Assistance will help you where ever you are. Whether you need some gas to make it to the next station or need to get your car towed to a repair shop, we’ll be with you wherever you are.

Vehicle Protection Plans

Your vehicle is one of the most expensive purchases you make. And we never know when auto repairs may happen. All new vehicles come with a standard manufacturer warranty. But in case if you are getting a pre-owned vehicle those those coverages are about to expire or expired. Therefore, in order to protect this investment and guarding against unexpected expenses we encourage all our customer to consider of getting a Vehicles Protection Plan from any of parents. Coverages include not only parts and labor, but roadside assistance and loaners.

We can help to get you a best possible service plan that fits you needs and your budget. Our team are glad to offer all kinds of products starting from Limited Powertrain Plans for basic coverages to Ultimate bumper-to-bumper Service Plans. All plans can be customized and priced accordingly to the vehicles you purchase and amount you are willing to spend.

GAP Insurance

Gap insurance pays the difference between the amount you owe on a loan and an insurance check for a totaled or stolen car. Cars are often considered “totaled” when the repair cost is more than a certain percentage of the vehicle’s value.

Without GAP, you could face paying thousands of dollars on a lost or totaled vehicle, all out of pocket. GAP is offered at very affordable price and can be added onto your approved loan. For just a few dollars a month, you can protect yourself against this kind of unexpected expense.

Roadside Assistance

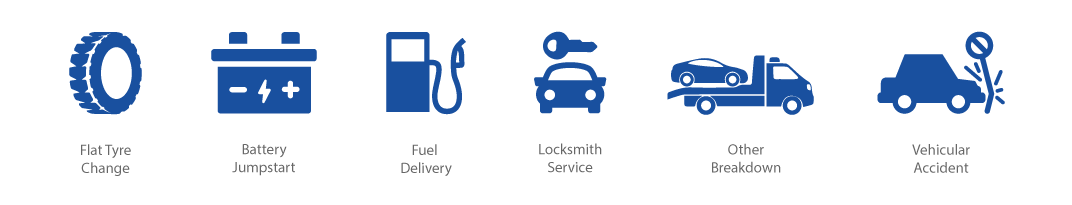

Have you ever gotten a flat tire, run out of gas or had a dead battery in your car? Vehicle breakdowns are a common but unavoidable part of owning and driving a car. Not only are breakdowns a hassle to deal with, they’re also incredibly costly. That’s why many vehicle owners opt to purchase emergency road service coverage, also known as roadside assistance.

Roadside assistance provides two main types of benefits. First, policyholders receive emergency roadside service in the event that their vehicle breaks down. Services might include fuel delivery, help changing a flat tire or towing to a service center if the issue can’t be immediately resolved. Second, roadside assistance helps mitigate the cost of an unexpected breakdown. Similar to a car insurance policy, roadside assistance policyholders pay a fee, or premium, to the service provider. When a breakdown does occur, the driver won’t have to pay out of pocket for the emergency services they receive, as long as they’re within the policy limit.